January 2022

2022 Business Plan and Budget

County Council adopted the 2022 Business Plan and Budget with amendments at the regular December 8, 2021, County Council meeting, resulting in a $66.6 million tax levy. For the average residential property owner, this will bring a municipal tax increase of $24 for the year.

County Council adopted the 2022 Business Plan and Budget with amendments at the regular December 8, 2021, County Council meeting, resulting in a $66.6 million tax levy. For the average residential property owner, this will bring a municipal tax increase of $24 for the year.

Highlights of the 2022 Budget include:

- Funding to address the housing crisis. An enhanced housing strategy will identify gaps across the housing continuum and what actions are needed to meet the County’s immediate and future needs. Plans are in place to use provincial funding to build an additional 66 affordable units in 2022.

- Community paramedicine. Oxford County Paramedic Services receives $2.4 million in provincial funding to expand its community paramedicine program, supporting local health care by reducing the number of patients in hospital beds, nursing homes, or emergency rooms.

- Enhanced long-term care. Woodingford Lodge receives $2 million in provincial funding to allow additional personal care time to support the health and wellbeing of residents.

- Investment in infrastructure. The capital plan makes major investment in our future, including Tillsonburg Wastewater Treatment Plant upgrade; Woodstock watermain extension work along County Road 4 and County Road 17; Drumbo Wastewater Treatment Plant expansion; and a second weigh scale at the Waste Management Facility.

Download the 2022 Business Plan & Budget

See presentations and video recordings from the special budget meetings at Speak Up, Oxford!

2022 Budget Survey

2022 Budget Survey

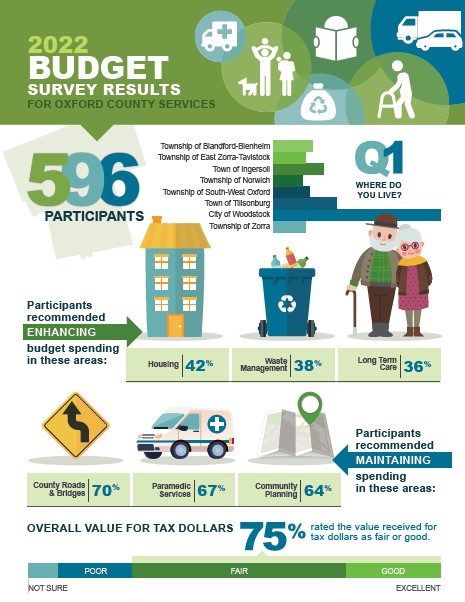

Between June 9 and August 31, 2021, a total of 596 people took part in the 2022 Budget Survey. Your feedback told us that housing, garbage and recycling, and long-term care were highest on your list of priorities for services delivered by Oxford County.

You also told us that roads and bridges, paramedic services (ambulance), and community planning are services you want to continue to maintain at their current levels.

Of those who responded to the survey, 75% said they received "fair" or "good" value for their Oxford County tax dollars.